Except they want to change the constitution to implement a graduated, or progressive, income tax structure.Īlthough right now, its state constitution requires a flat tax (currently at 4.95%), the Illinois legislature recently voted to put an amendment on the 2020 ballot to scrap that provision. Pritzker and his legislative allies want to do just that. Amend the constitution? It turns out that Democratic Gov. But the Illinois Supreme Court has ruled that is forbidden under the state constitution. Without bankruptcy as an option, the preferred solution might be to cut back on the metastasizing retirement benefits for its public-sector employees. The state’s total unfunded pension liabilities that are guaranteed to be paid have soared to $446 billion, according to the 2018 report, “Ranking the States by Fiscal Condition,” by the Mercatus Center at George Mason University.

If states could declare bankruptcy, Illinois would be first in line seeking to shed its debts.

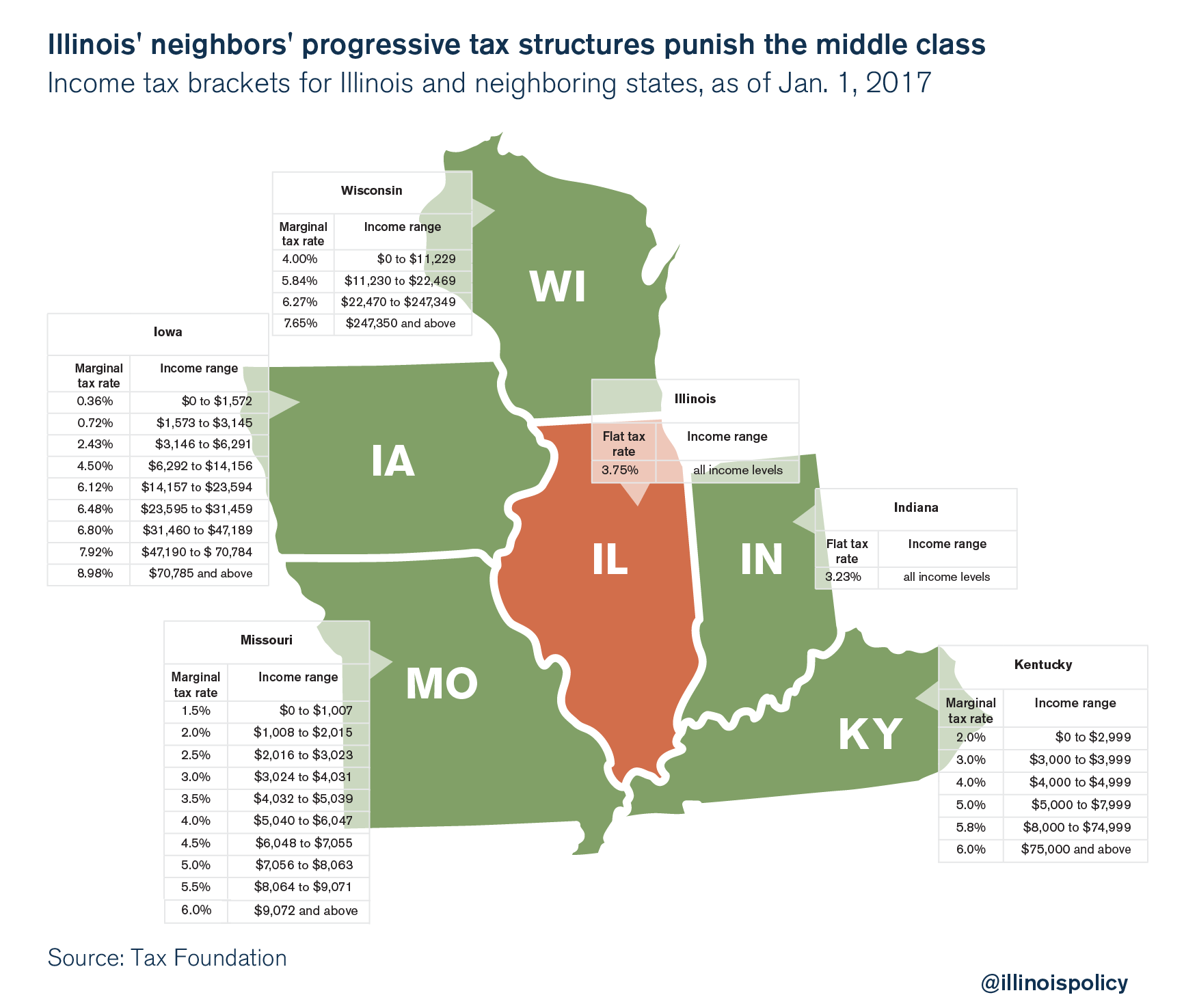

Switching to a progressive income tax structure would drive Illinois even further behind Wisconsin

0 kommentar(er)

0 kommentar(er)